It's the law!

Should your company win a federally funded construction project, you must understand government-imposed payroll practice regulations. Failure to adhere to specific standards can impose fines. Such projects require contractors to pay at least a minimum rate determined by the federal government or the state—whichever is higher. To adhere to these standards, contractors must document wages in a certified payroll report.

Certified Payroll Qualifies Companies for Federal Contracts

Why do most construction companies recognize Certified Payroll as a standard accounting practice?

The US Chamber of Commerce states:

Certified Payroll is a requirement stemming from the Davis-Bacon Act. In 1931, Congress passed the Davis-Bacon Act to protect workers from low hourly pay.

You must comply with Certified Payroll requirements if your business works on a federal contract over $2,000. The law applies to contractors and subcontractors hired to complete construction, alteration or repair of public buildings or public works. The law applies to contractors and subcontractors hired to complete construction, alteration or repair of public buildings or public works.

The Davis-Bacon Act mandates that these contractors and subcontractors pay prevailing wages and, where applicable, benefits to their employees. These prevailing wages are determined by the U.S. Department of Labor, based on the wages and benefits paid to workers in similar trades and occupations within the same geographic area. This ensures that the wages paid are reflective of the local economic conditions, preventing contractors from undercutting local wage standards.

Additionally, the Act requires that accurate records of hours worked and wages paid be maintained by contractors and submitted through weekly certified payroll reports to the contracting agency. This level of documentation and oversight is designed to enforce compliance with the law, thereby protecting both the workforce and the integrity of local labor markets."

This expanded passage blends the details provided in Their article about operational mechanics, compliance, and the purpose of the law with the original text of Your article, offering a comprehensive understanding in a consistent tone.

1. What is the broader purpose of the Davis-Bacon Act?

The primary aim of the Davis-Bacon Act is to prevent the depression of local wage standards by ensuring that contractors cannot offer lower wages than what is typically expected in the area, thus protecting the local workforce and ensuring fair competition.

2. How is the prevailing wage determined?

The prevailing wage under the Davis-Bacon Act is set by the U.S. Department of Labor, which assesses the wages and benefits paid to workers in similar roles and trades within the same geographical region to establish a standard.

3. What exactly does the Davis-Bacon Act require from contractors and subcontractors?

The Davis-Bacon Act mandates that contractors and subcontractors working on federally funded projects must pay workers the prevailing wages and potentially offer benefits similar to those in the local area, as well ensuring that they maintain accurate records of workers' hours and wages, and submit weekly certified payroll reports to the contracting agency.

What additional administrative requirements does the Act impose on contractors?

Beyond setting wage standards, the Act necessitates that contractors working on federal projects submit certified payroll reports. These reports are crucial for proving compliance with the prevailing wage requirements stipulated by the law.

How long should contractors maintain payroll records post-project?

Contractors are required to hold onto payroll records for a minimum of three years following the conclusion of a project. This duration is essential for compliance and future reference needs. Whether for audits, disputes, or regulatory checks, keeping these documents accessible ensures that contractors can provide necessary information when requested.

In summary:

- Retention Period: At least 3 years after project completion

- Purpose: Audits, legal compliance, and potential disputes

Adhering to this practice safeguards your business against potential legal ramifications and contributes to smooth operations.

What are the implications of the Act for contractors?

Contractors are required to adhere to the Act by submitting certified payroll reports. These reports serve as proof that they are compensating their workers according to the prevailing wage standards while engaged in federal projects.

Why was the Davis-Bacon Act enacted?

The Act was passed in response to the practice of contractors submitting low bids for government projects by planning to pay minimal wages. This law was intended to prevent such underbidding that compromised fair labor wages and conditions.

What exactly does the Davis-Bacon Act require?

The Davis-Bacon Act mandates that contractors and subcontractors involved in federally funded projects pay workers the prevailing wages and potentially benefits that are standard for similar roles in the geographical area. This standard is determined by the U.S. Department of Labor.

How does the Act influence wage determination?

The Davis-Bacon Act introduced the concept of a "prevailing wage," which is essentially the average wage paid to workers of the same type in a particular area. This helps in maintaining a standard wage level for similar work across various regions.

Prevailing Wage

Prevailing wage, a benchmark for similar work performed in surrounding geographical areas, establishes an even playing field for employers and laborers; it eliminates low-balling wages and offers higher pay to steelworkers.

Interestingly, prevailing wage only applies to hourly laborers and not salaried individuals. It protects workers from exploitation.

Certified Payroll stipulates weekly pay for employees. This unusual arrangement—outside the restaurant industry—benefits cash flow-based businesses.

What are some exceptions to prevailing wage requirements in commercial construction projects?

Understanding Exceptions to Prevailing Wage Requirements in Commercial Construction

When tackling commercial construction projects, it's vital to understand that prevailing wage laws may not uniformly apply across all scenarios. Here are some common exceptions that allow flexibility depending on specific circumstances:

-

Project Size and Cost: Usually, there's a set threshold for the cost or scale of a project beyond which prevailing wage laws take effect. Smaller projects under this threshold may not require adherence to these wage standards.

-

Type of Project: Not all construction activities are subject to rigid wage stipulations. For example, privately funded ventures or certain specific renovations often escape these requirements, particularly if the developments don't fall under the traditional definition of public works.

-

Owner-Occupied Projects: If the owner of the property is directly involved in occupying the building post-construction, prevailing wage statutes might not apply. This exemption is designed to benefit owner-operators actively participating in the construction and use of the building.

-

Economic Incentive Zones: Some geographic areas, identified as enterprise or economic development zones, may be exempt from prevailing wage laws. The purpose here is to spur economic growth by attracting businesses through reduced operational costs, including labor.

-

Emergency Works: In situations where urgent construction is necessary to safeguard public health or safety, prevailing wage requirements are sometimes waived to expedite project initiation and completion.

Each jurisdiction can have nuances in how these exceptions are applied. Therefore, contractors and developers should seek detailed, local legal guidance to ensure compliance with prevailing wage regulations specific to their construction projects.

What are the penalties for violating the Davis-Bacon Act, including failure to submit certified payroll reports or providing incorrect information?

Violating the Davis-Bacon Act, particularly in regards to certified payroll reporting, triggers severe penalties. Should your business miss filings or submit incorrect payroll information, it faces substantial consequences imposed by the Department of Labor (DOL).

Here’s what could happen:

Federal Contract Prohibitions: Your company may be barred from entering federal contracts for a period of up to three years.

Financial Penalties: The DOL may withhold payments on current contracts. This ensures that funds are available to compensate employees for any owed overtime wages.

Contract Termination: The failure to comply with the act can lead to the immediate termination of ongoing federal contracts.

Legal Consequences: Providing false information might result in civil or criminal legal actions. Convictions can carry fines and even terms of imprisonment.

If penalized, businesses have the right to contest these decisions. Initially, an administrative law judge will hear your case. Should you need to further contest the ruling, you can appeal to the Administrative Review Review Board (ARB), and potentially, the federal courts.

Certified Payroll Affects which Segments?

The US Government requires the following four main categories of construction to use Certified Payroll: *

- Residential construction

- Heavy construction

- Building construction

- Highway construction

- Plumbing

- Carpentry

- Masonry

- Concrete finishing

- Electrical work

- Insulation work

- Laborer work

- Lathing

- Painting

- Power equipment operation

- Roofing

- Sheet metal work

- Truck driving

- Welding

What information is typically included in certified payroll reports submitted by contractors and subcontractors?

Employers must file Form WH-347, which reports the type of labor performed, hours worked, and the prevailing wage paid (along with other data).

The Department of Labor reviews Certified Payroll reports and may issue severe penalties for violating the Davis-Bacon Act, including civil or criminal prosecution. Other consequences can include fines or loss of government contracts.

To elaborate further, certified payroll reports must include comprehensive details to ensure compliance with federal regulations.

These reports feature several key fields:

Job Information: This section captures specifics about the construction project, including project name, location, and the agency providing the funding.

Employee Information: Here, every worker's name, their job classification, and total hours worked during the pay period are documented.

Wage and Benefit Information: Detailed information about the wages paid is required, which includes hourly rates, overtime compensation, fringe benefits, and any deductions.

Compliance Information: This part includes documentation that the contractor or subcontractor is adhering to federal and state prevailing wage laws.

Certification: Finally, the report must be signed and certified by the contractor or subcontractor, attesting to the accuracy and completeness of the information provided.

Each of these categories is crucial for a thorough understanding of the payroll and labor dynamics on federally funded projects, ensuring transparency and adherence to legal standards.

What are the requirements for the WH-347 from issued by the United States Department of Labor?

The WH-347 form, issued by the United States Department of Labor, necessitates detailed employee information to ensure accurate reporting and compliance with federal regulations. Here's what you need to include on this form:

Employee Information

- Employee Details: Provide the name and the last four digits of each employee's Social Security number.

- Wage Information: List employee wages alongside the corresponding number of exemptions.

- Classification: Specify the work classification for each employee.

Work Schedule & Compensation

- Working Days: Record the days and dates on which work was performed.

- Hours Worked: Document the hours worked daily by each employee, including separate entries for overtime.

- Pay Details: Note the rate of pay, gross earnings, and net wages paid for the week.

Tax & Deductions

- Deductions: Outline all deductions from wages, including FICA and withholding tax, along with a tally of total deductions.

Additional Details for compliance

- Multiple Crafts: If an employee performs more than one craft, this should also be recorded.

- Wage Exceptions: Any reasons for wage exceptions must be noted.

Properly filling out the WH-347 form with these details ensures compliance with labor laws and facilitates accurate payroll processing.

Common Mistakes in Certified Payroll Submissions

Submitting certified payrolls can be complicated, and many businesses make mistakes that could have serious consequences. Here are some frequent errors to watch out for:

-

Failure to Sign and Certify Records

- Ensure all documents are properly signed and certified to avoid compliance issues.

- Ensure all documents are properly signed and certified to avoid compliance issues.

-

Unclear or Incomplete Employee Details

- Employee information must be clear and comprehensive. Double-check for legibility and completeness.

- Employee information must be clear and comprehensive. Double-check for legibility and completeness.

-

Discrepancies Between Hours Worked and Pay

- Always reconcile the hours reported with the wages paid to employees to prevent discrepancies.

- Always reconcile the hours reported with the wages paid to employees to prevent discrepancies.

-

Overlooking Fringe Benefits

- Include any applicable fringe benefits to ensure accuracy in payroll calculations.

- Include any applicable fringe benefits to ensure accuracy in payroll calculations.

-

Delayed or Absent Submissions

- Timely submission is crucial. Avoid penalties by submitting your certified payrolls on schedule.

Failing to address these areas can lead to steep fines, contract terminations, and a loss of eligibility for future federal contracts. Taking the time to review and correct these common errors can safeguard your business interests and maintain compliance.

How your software Can Help

Your accounting software should provide the instructions and data you need to complete Form WH 347.

Payroll setup should be configurable by state, work classifications, pay rate tables (straight and overtime), fringe benefits, and hours for your employees and subcontractors.

Data should flow seamlessly from a timekeeping app to your accounting system.

How Can Construction Companies Streamline Certified Payroll Reporting and Ensure Compliance with the Davis-Bacon Act?

Streamlining certified payroll reporting in construction and ensuring compliance with the Davis-Bacon Act can be complex and time-consuming. While hh2 does not directly handle certified payroll or WH-347 forms, its solutions support payroll-related processes and provide tools to simplify overall back-office management.

Here's how hh2 can help:

-

- Efficient Data Management: hh2 allows users to input employee time data once, reducing the need for repetitive data entry. This organized data can then be exported or integrated into certified payroll software to generate weekly payroll reports.

- Time and Cost Savings: By automating time tracking and payroll data synchronization, hh2 helps contractors save time and reduce administrative workloads. These efficiencies free up resources for other critical tasks.

Leveraging hh2 for general payroll workflows allows construction companies to optimize their data management and streamline compliance when paired with certified payroll tools.

- Efficient Data Management: hh2 allows users to input employee time data once, reducing the need for repetitive data entry. This organized data can then be exported or integrated into certified payroll software to generate weekly payroll reports.

Simplifying Certified Payroll Management with Integrated Solutions

Navigating certified payroll complexities, especially for Davis-Bacon Act compliance, requires specialized tools. While hh2 Cloud Services does not provide certified payroll-specific features, it integrates seamlessly with other payroll systems and supports efficient workforce management, indirectly aiding compliance efforts.

Streamlined Data Entry and Reporting

hh2 simplifies payroll data handling by enabling users to input worker details once, which can then be synced with external certified payroll tools to ensure timely reporting. This integration reduces manual errors and ensures accurate data is ready for certified payroll submissions.

Supporting Compliance Through Integration

Although hh2 does not include certified payroll reporting features such as WH-347 form generation, it aids compliance by:

- Synchronizing payroll data with accounting systems, enabling seamless integration with certified payroll software.

- Providing tools for setting up project-specific payroll groups, ensuring accurate tracking of prevailing wage classifications.

These features help contractors maintain organized payroll systems and streamline compliance workflows when paired with certified payroll solutions.

hh2 Setup for Certified Classes

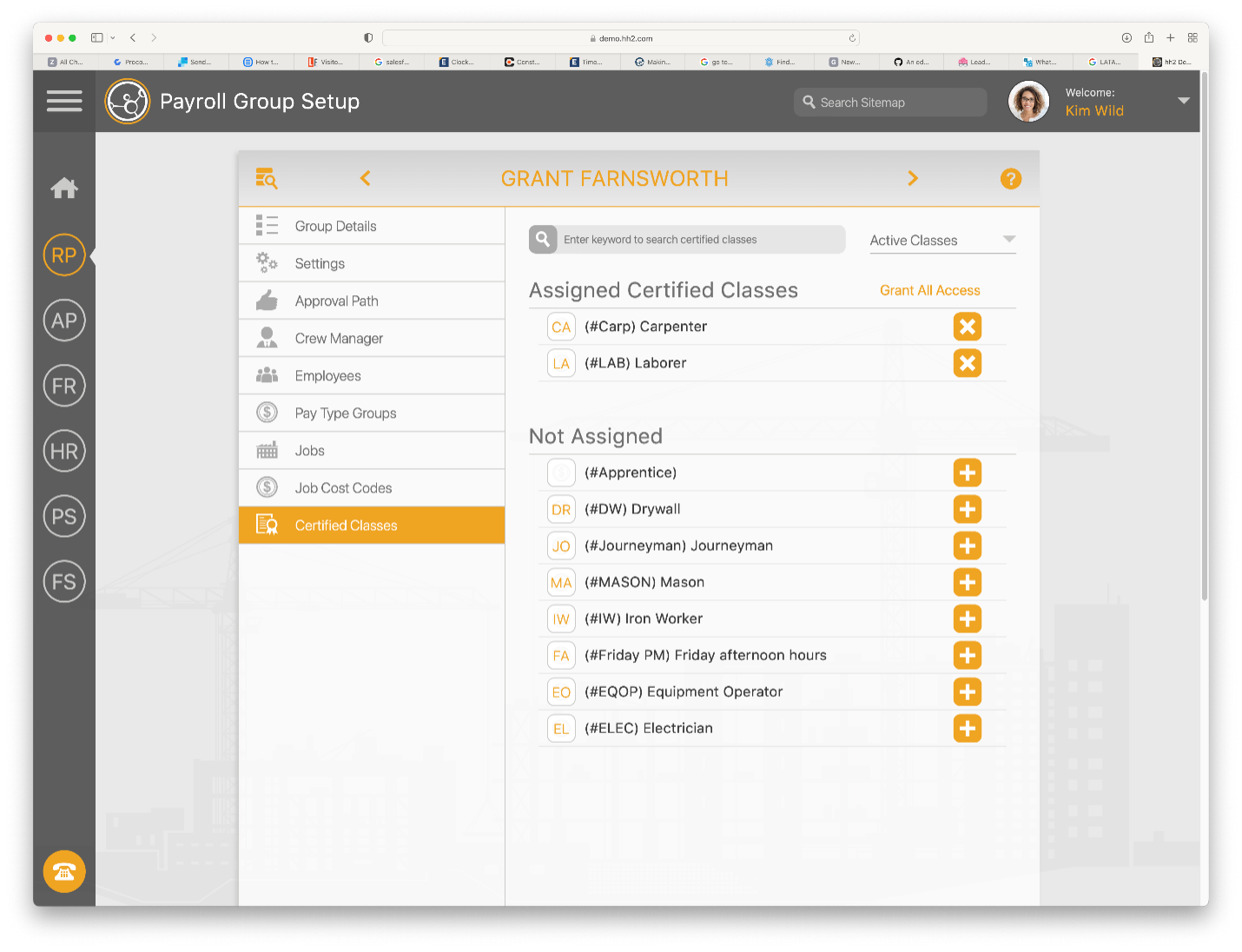

hh2 Remote Payroll simplifies the process by providing an easy way to move certified classes from your accounting system through a synchronization client. Once configured, the hh2 Synchronization Client works in the background to update the hh2 Remote Payroll website and mobile apps with the latest certified classes for use on the project.

hh2 then streamlines the process of using Certified Classes for time tracking through the configuration of each payroll group.

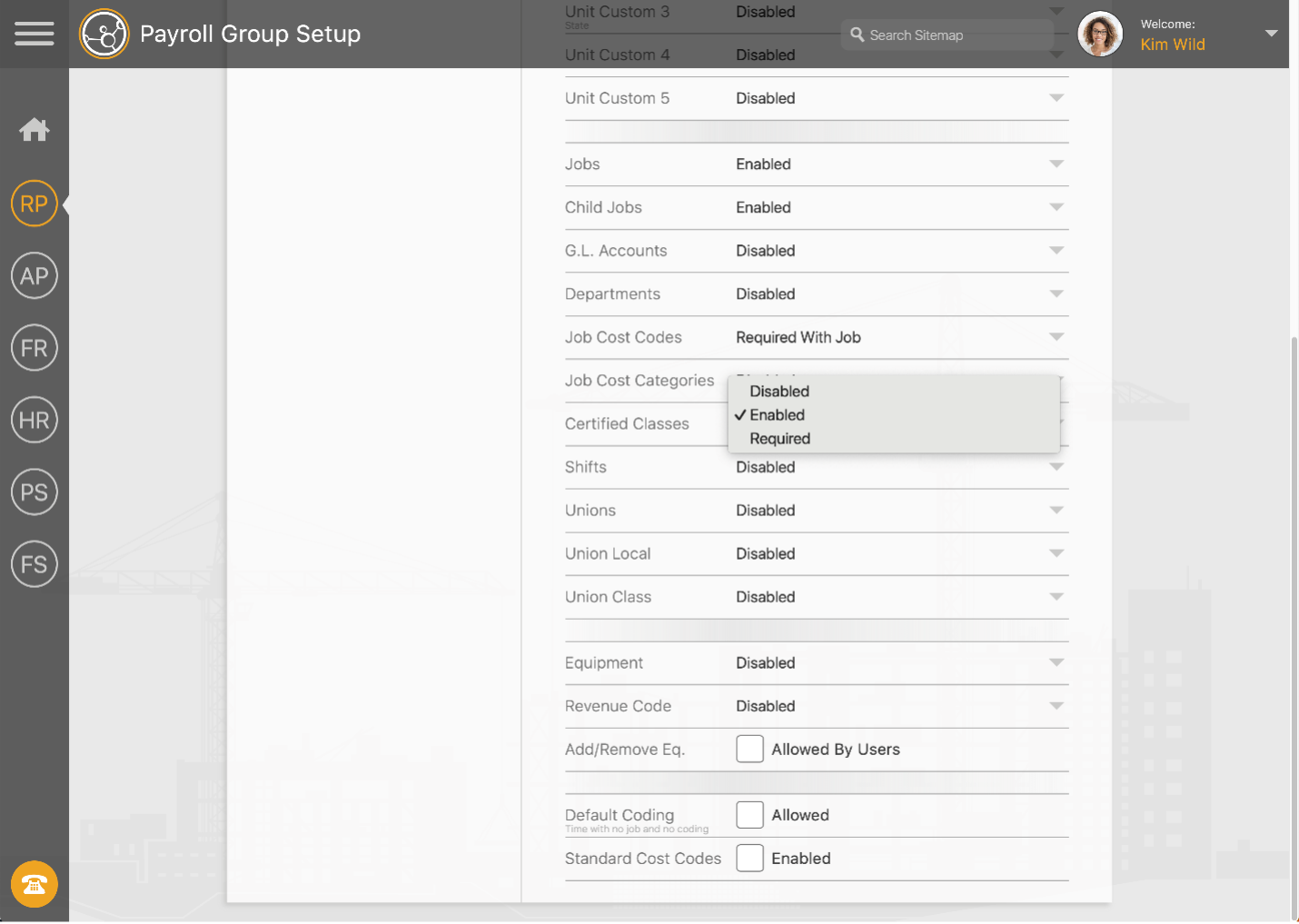

Click ‘Enabled’ or ‘Required’ on the app’s Payroll Group Setup screen to activate Certified Classes.

You can also determine the Certified Classes you want each group to use. This ensures the correct prevailing wages are used for employees within the group.

Certified Classes within the Timecard

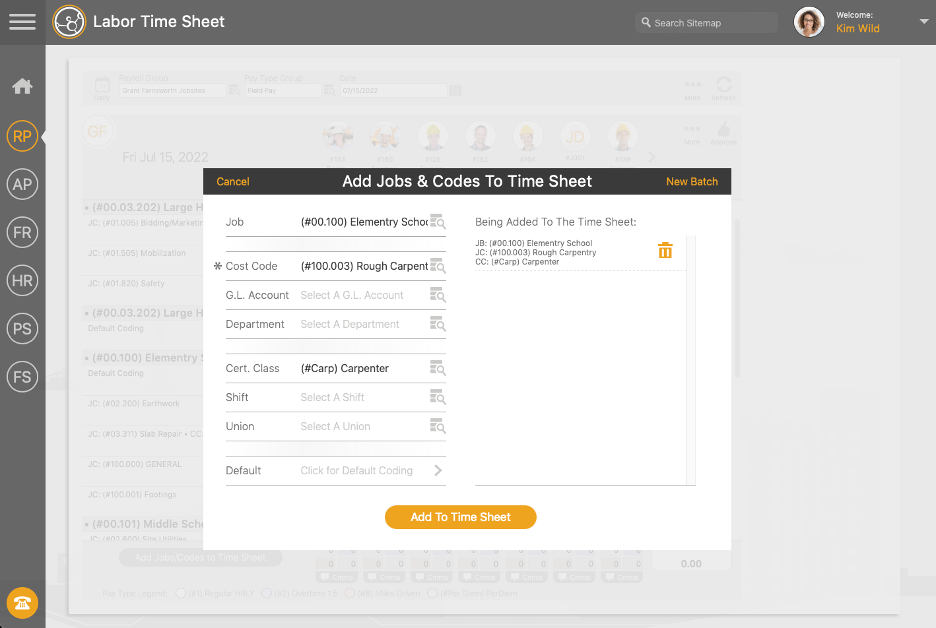

The payroll group now has access to certified classes. Labor performed on the project can be set up to include certified classes for each code.

When adding jobs or codes to the time card or while punching in and out of the app, Certified Classes can be selected for coding.

Compliance Best Practices

When your company bids on public works or government-funded projects, consider using hh2 Remote Payroll, a cost-effective solution that complies with Certified Payroll stipulations. Risk aversion and peace of mind mean everything to your controller or CFO in a competitive bidding world.

Rolls into Accounting and Project Management Software

Best of all, hh2 Remote Payroll seamlessly integrates with Sage 300 Construction and Real Estate, Sage 100 Contractor, and Procore solutions.

Further Readings

- What is certified payroll?

- Why is certified payroll so important to construction?

- When is certified payroll required?

- You complete guide to certified payroll for construction

Supercharge Your Back-Office

Eliminate manual data entry and manual errors while simplifying nearly every back-office process with hh2's construction solutions.